Performance

Solutions

A unified framework to understand how your portfolio creates value. Our Performance Solutions deliver clear monitoring, attribution, and independent price verification, giving you confidence in your results and their underlying drivers.

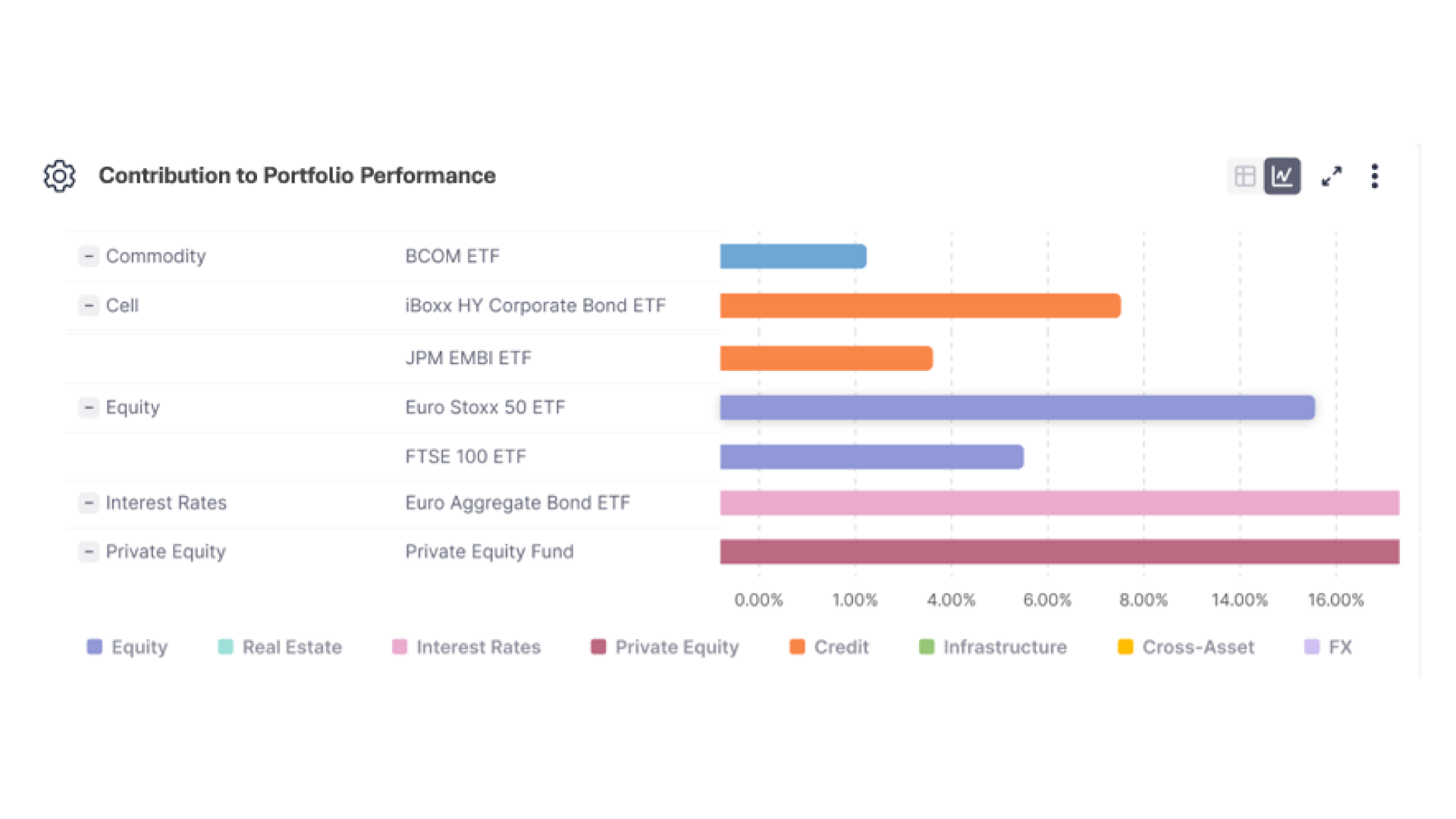

Performance Monitoring

Gain a comprehensive view of how your portfolio performs over time and what truly drives its returns. Track historical performance contributions across strategies, sectors, regions, or any custom classification you define. Evaluate the risk/return profile of the portfolio by analysing performance and volatility contributions while accounting for diversification benefits through correlations. Compare outcomes against benchmarks and assess risk-adjusted returns to understand relative performance.

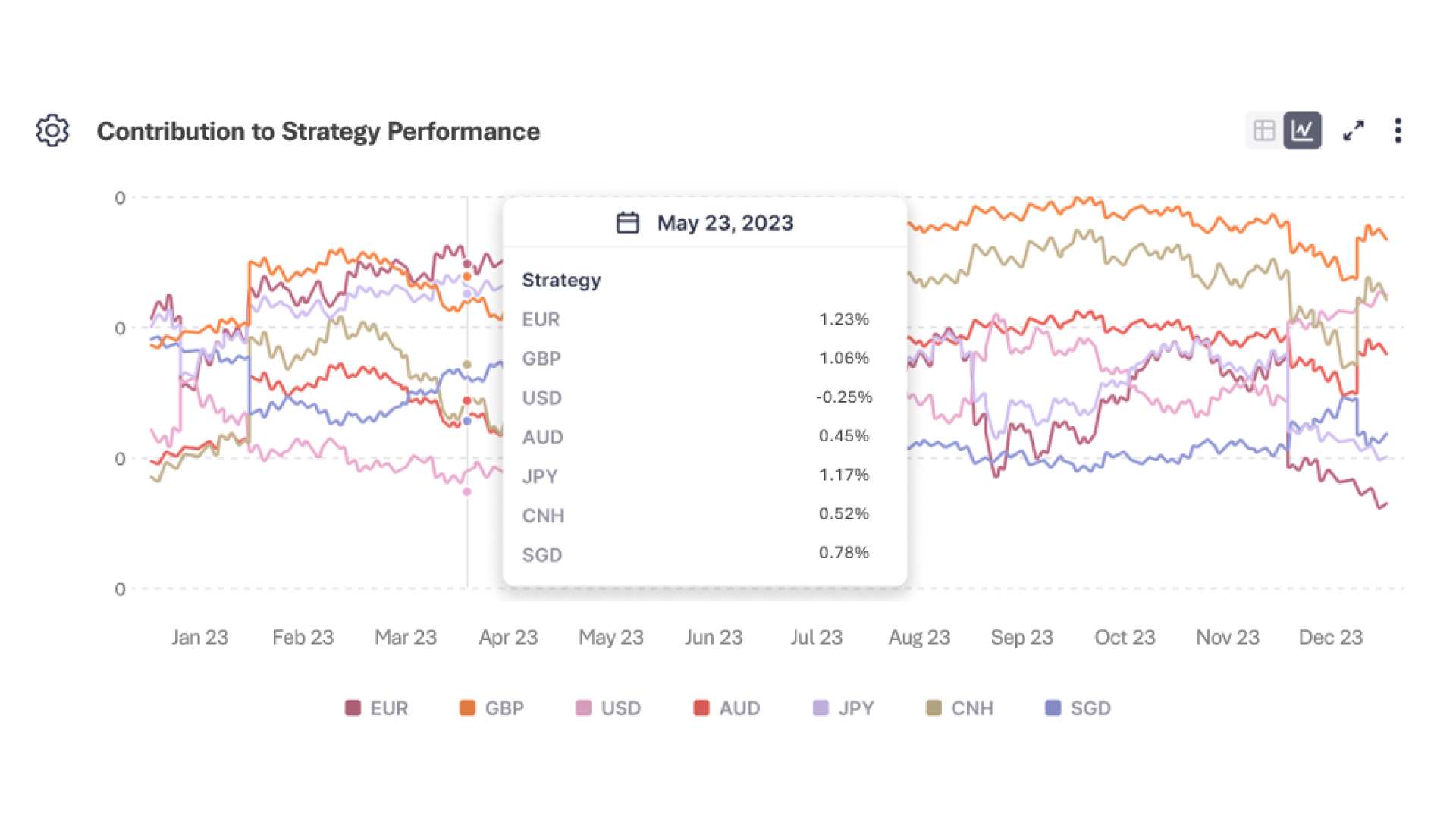

Performance Attribution

Understand precisely which positions and themes are driving your returns with granular, position-level performance attribution across sectors, industries, maturity buckets, and any custom grouping you choose. Monitor how contributions evolve through time and compare them against benchmarks to identify whether the portfolio is capturing upside effectively or lagging in periods of stress. This provides a transparent view of which exposures add value and which detract from performance.

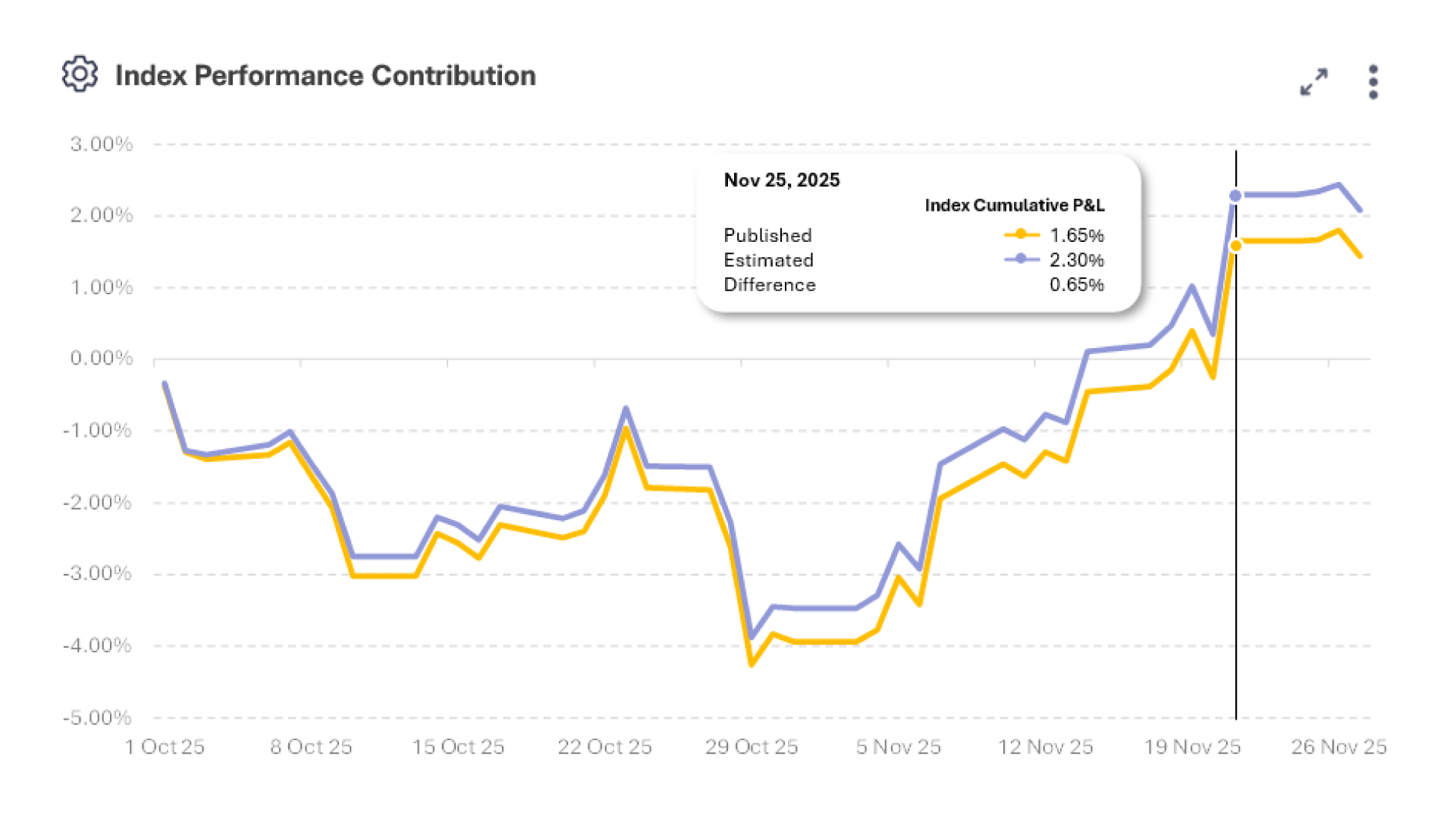

Independent Price Verification

Enhance transparency and gain trust in your QIS allocations with independent daily price verification. We reconcile index levels against third-party market data to validate provider-published NAVs, highlight discrepancies, and strengthen the accuracy of your performance analysis. This process supports robust decision-making and helps investors meet regulatory requirements.